Can Serbia Do Without Health Insurance Contributions, Like Montenegro? – Employers and Trade Unions Fear That State Would Increase Other Charges

Source: eKapija

Sunday, 13.08.2023.

Sunday, 13.08.2023.

12:09

12:09

Sunday, 13.08.2023.

Sunday, 13.08.2023.

12:09

12:09

Illustration (Photo: RomanR/shutterstock.com)

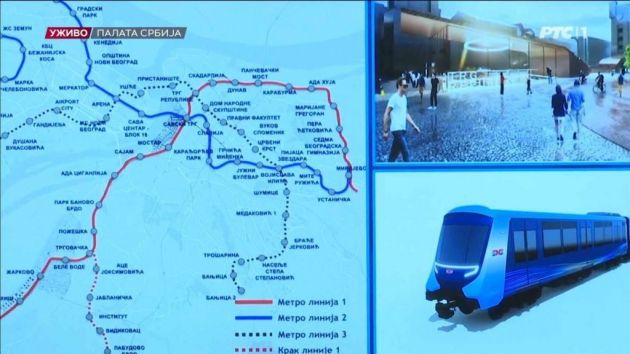

In Serbia, this model was proposed in 2014 by the then minister of economy, Sasa Radulovic, and the NALED proposed it last year.

– The proposition of the NALED is to consider the removal of health insurance contributions and shift to budget financing, that is, general taxes, whereby all citizens would have health insurance – the director for competitiveness and investments at the NALED, Dusan Vasiljevic, said last year.

Still, neither the employers nor the trade unions in Serbia are in favor of this idea, and their main counter-argument is that, in that case, the state would increase other taxes.

– I am skeptical regarding this issue. The fact is that the health insurance contributions are evenly spread between the employer and the employee and that they amount to 10.2% in total, if I’m not mistaken. But the fact is that, if health contributions were shifted to the budget, it would be slightly under EUR 2 billion. And the state doesn’t like to have its budget messed with. The state would then be forced, due to the lack of budget space, to find solutions for compensation through various forms of specific-purposes taxes. The simplest thing for them would be to increase the VAT, the excise taxes, or to increase the wage taxes, where everything that we have been fighting for as the Association for years now, but not just us, would be ruined. It would be an inevitability that the state would not hesitate about – the director of the Serbian Association of Employers, Srdjan Drobnjakovic, said for eKapija.

According to him, there are those who argue in favor of it, who say that those 10.2% would go into employees’ net salaries, thereby increasing the consumption, and through it the state’s income as well.

– And are we sure that the employer would be obliged to do so and according to which law? Even Robert Owen and Saint-Simon and Charles Fourier, as the biggest social utopians, would say no – Drobnjakovic points out.

The secretary-general of the Association of Free and Independent Trade Unions (ASNS), Nebojsa Rajovic, has a similar opinion.

– Only the state would benefit from the potential removal of mandatory health insurance, that is, from people no longer having to pay the contributions, as it would increase the taxes by at least the amount of the revenues it had from health insurance and it would additionally increase the budget and then it would distribute health funds arbitrarily, with a bureaucratic slowness and the mandatory endemic corruption. The citizens would seem to have their income increased around 0%, but only in the short term, and what they would get “for free” from the already problematic healthcare system, we can only guess – Rajkovic says for our portal.

According to him, what could be discussed in the height of the contribution.

– The question is what the contribution should be, how the funds are spent. What’s especially problematic is the principle of reciprocity, which is implemented in the way that we have the same range of health services, and we pay the contributions in various amounts, and a range of other issues that would be the subject of a health insurance reform, but the question of insurance, that is, the payment of contributions, is indisputable – Rajkovic points out.

Illustration (Photo: Shutterstock/bibiphoto)

What do experts say and can the example of Montenegro be our guide?

Since the beginning of 2022, contributions for health insurance are no longer paid in Montenegro, as part of a wider tax reform called Europe Now. That move has led to a debate in Serbia too. When this kind of a reform was proposed by some of the opposition parties, the minister of finance, Sinisa Mali, categorically rejected the idea.

– If health insurance contributions were removed, the consequence would be the loss of general state income by around RSD 330 billion. The only reasonable thing in that case would be to increase the VAT, by a minimum of 5%, so as to maintain the same level of income. The proportions of such an irresponsible policy would be terrifying, primarily to the citizens, because it would entail an increase in all prices. In any case, under the current conditions of the high, threatening inflation, the income growth would be additionally devalued by a higher inflation – Mali said at the time.

According to Aleksandar Vasic, a member of the Management Board of the Association of Tax Advisers of Serbia, there are two ways to implementing this potential reform.

– There are two ways. One is to reduce the expenditures, that is, to rationalize the health system, but in a way which doesn’t affect the quality. The other is tax policy, which would define from which sources the expenditures are financed, from contributions, as is the case now, or from some other taxes – Vasic says.

He adds that there are only two sources from which health insurance funds could be secured.

– Either through redistributing budget expenditures, which would mean that financing is canceled for somebody else, or through increasing tax revenues, for example, by increasing the VAT and/or excise taxes. I personally believe that “test reforms” could be done first, which would encompass a reduction of contributions in order to lower the charges on the salaries and, for example, an increase of excise taxes (cigarettes, alcohol…), maybe even of the VAT, by directing those increased revenues toward the financing of health care – our interviewee says.

He also points out that we mustn’t forget about rationalizations, which have to be constantly implemented.

– It’s easy to adopt quick and radical measures, as Montenegro has done, but it’s measures that are sustainable in the long term that should be implemented. We need to be aware that we have no more room for mistakes – Vasic points out.

The move of Montenegro, although considered financially unsustainable, is functioning for the time being.

Recently, the Montenegrin finance minister, Aleksandar Damjanovic, said that the state budget was full and that “the current good indicators give hope and make us optimistic that things would continue just as well for the rest of the year too,” and Montenegro has the highest average salaries in the region.

The average net salary in June amounted to EUR 906.77, whereas the average salary of, for example, teachers, amounts to EUR 813.85.

I. Zikic

Companies:

Unija poslodavaca Srbije Beograd

Unija poslodavaca Srbije Beograd

Asocijacija slobodnih i nezavisnih sindikata Beograd

Asocijacija slobodnih i nezavisnih sindikata Beograd

Ministarstvo finansija Republike Srbije

Ministarstvo finansija Republike Srbije

Udruženje poreskih savetnika Srbije Beograd

Udruženje poreskih savetnika Srbije Beograd

NALED Beograd

NALED Beograd

Ministarstvo finansija Crne Gore

Ministarstvo finansija Crne Gore

Tags:

Serbian Association of Employers

NALED

Association of Free and Independent Trade Unions

ASNS

Ministry of Finance

Association of Tax Advisers of Serbia

Ministry of Finance of Montenegro

Sinisa Mali

Nebojsa Rajkovic

Dusan Vasiljevic

Srdjan Drobnjakovic

Aleksandar Vasic

Aleksandar Damjanovic

Sasa Radulovic

health insurance contributions

removal of health insurance contributions

financing of health insurance

Comments

Your comment

Most Important News

Full information is available only to commercial users-subscribers and it is necessary to log in.

Follow the news, tenders, grants, legal regulations and reports on our portal.

Registracija na eKapiji vam omogućava pristup potpunim informacijama i dnevnom biltenu

Naš dnevni ekonomski bilten će stizati na vašu mejl adresu krajem svakog radnog dana. Bilteni su personalizovani prema interesovanjima svakog korisnika zasebno,

uz konsultacije sa našim ekspertima.

Izdanje Srbija

Izdanje Srbija Serbische Ausgabe

Serbische Ausgabe Izdanje BiH

Izdanje BiH Izdanje Crna Gora

Izdanje Crna Gora

News

News